Payroll Administration

Your focus should be on growing your business, not running payroll. Save time with our simple process that takes just minutes to complete.

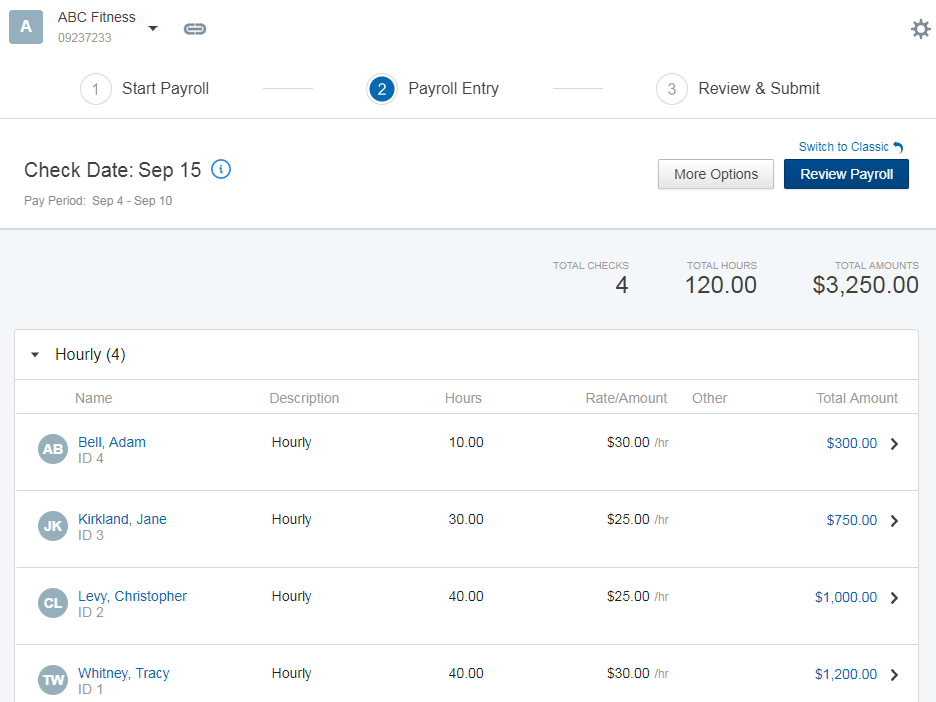

Valley Administrative Services lets you process payroll in a few simple steps.

Run payroll wherever and whenever it’s convenient for you. You no longer have to phone and fax payroll information to a representative or even install or upgrade software. With everything online, it’s simple and convenient so you can focus on what’s most important for your business.

Gain peace of mind with payroll taxes automatically paid and filed. You won’t have to worry about calculating and filing your payroll taxes. We automatically calculate, file and pay your federal, state and local payroll taxes for you, helping you avoid costly IRS fines.

Once you enter payroll, your taxes are managed completely by us – there’s no more work for you.

- Process payroll online, with no payroll software downloads or installs.

- No need to phone or fax in payroll like traditional payroll companies.

- Get online reports anytime.

- Run payroll in just a few minutes.

- Payroll wages, deductions and payroll taxes are automatically handled.

- Use direct deposit or simply print checks.

- Leading security methods and technology keep sensitive information protected.

- Backed by 40 years of payroll management experience.

- Tax Guarantee

Small Business Payroll Services

- You have 24/7 access to online payroll reports.

- You save money with an affordable service and can pay your independent contractors (1099s) on the same payroll as your employees.

- You can enter payroll whenever and wherever you want with our online system.

- We’ll help to ensure you never miss a pay period. We’ll send you email reminders when it’s time to process.

- With employee online access to their individual payroll information, you won’t have to manage and distribute payroll data to your employees.

- With our accounting integration, you can import payroll information into a general ledger to save time and reduce entry errors